Views – 295

BursaKakis Channel :

Uob Kay Hian Daily Top Pick, 24 Nov 2016

Ghlsys, 0021

Close, 0.83

Breakout, 0.855

Buy TP, 0.985, 1.04

Support, 0.78

SL, 0.775

Time Frame, 2 Weeks to 2 Months

Insas, 3379

Close, 0.72

Breakout, 0.755

Buy, TP, 0.82, 0.875

Support, 0.69

SL, 0.685

Time frame 2 weeks to 2 months

Leonfb, 5232

Close, 0.515

Breakout, 0.525

Buy TP, 0.59, 0.61

Support, 0.48

SL, 0.475

Time frame, 2 weeks to 2 months

Thanks

+++±+++++++

[Forwarded from Itchy Itchy Trader Club (J C)]

M+ Online Morning Buzz – 24Nov16

Dow Jones: 19,083.18 pts (+59.31pts, +0.31%)

U.S. stockmarkets crept higher as Dow (+0.3%) closed at a fresh record high, boosted by industrial shares ahead of the Thanksgiving public holiday.

FBM KLCI: 1,630.38 pts (+1.06pts, +0.07%)

The FBM KLCI chalked in marginal gains yesterday, after reversing all its intraday losses on last minute buying support amongst selective plantation heavyweights. The immediate resistance level is located around the 1,645 level.

Crude Palm Oil: RM2,954 (+RM26, +0.89%)

Crude palm oil prices closed higher for the third consecutive session, tracking the gains in soybean oil which the latter saw an increase in biofuel mandate. The RM3,000 level will serve as the immediate resistance level.

WTI Crude Oil: $47.96 (-$0.02, -0.04%)

Crude oil prices closed marginally lower on doubts over the upcoming potential output cut could curb global supply glut. Crude oil prices might head towards the US$50 level.

Gold: $1,188.32 (-$24.00, -1.98%)

Gold prices extended its losses to its lowest level since February 2016 after the latest minutes meeting from the US Federal Reserve signals to an interest rate hike next month. The US$1,150 level will serve as the next support level.

Bursa Malaysia Trade Statistics – 23Nov16

Institutions: Net BUY 98.8 mln (61.2%)

Retail: Net BUY 61.5 mln (15.5%)

Foreign: Net SELL 160.3 mln (23.3%)

Potential Momentum Stocks – 24Nov16

Stock Name: MMCCORP (2194)

Entry: Buy above RM2.45

Target: RM2.66 (8.6%), RM2.80 (14.3%)

Stop: RM2.30 (-6.1%)

Shariah: Yes

Technical: Monitor for breakout

Stock Name: GHLSYS (0021)

Entry: Buy above RM0.82

Target: RM0.875 (6.7%), RM0.915 (11.6%)

Stop: RM0.80 (-2.4%)

Shariah: Yes

Technical: Short- term consolidation breakout

Source: Bloomberg, M+ Online

++++++++++++=

TradetheHotstocks, [24.11.16 06:58]

Malakoff, Bumi Armada, Ekovest, MMC Corp, AppAsia, Mercury Industries, Titijaya, MBM Resources, Parkson and Genting Plantations | The Edge Markets

http://www.theedgemarkets.com/en/article/malakoff-bumi-armada-ekovest-mmc-corp-appasia-mercury-industries-titijaya-mbm-resources

++++++++++++=

Market News Roundup

1⃣ TITIJAYA plans to enter the affordable housing segment with a proposed development worth RM2.4b in GDV in Bukit Raja, Selangor, in 2Q of 2017.

2⃣ EKOVEST said it is close to securing approximately RM400m more construction contracts for FY2017, which will boost its order book to over RM7b.

3⃣ APPASIA’s unit, EISB, has been appointed as Alibaba Cloud’s non-exclusive reseller to drive the sale of certain cloud and computing and technology products and services for the latter.

4⃣ MERCURY is exiting the auto refinish business due to increasing challenges in the segment from the slowing domestic economy, uncertainties in the global economies and the weaker RM.

5⃣ MALAKOFF has launched arbitration proceedings against Japan’s Sumitomo Corp, Zelan Hldgs SB & Sumi-Power Msia SB seeking RM785m for breach of contract.

Financial Result Highlight

ARMADA reported 3Q net loss of RM96.71m versus a net profit of RM70m a year earlier as the O&G support services provider registered lower revenue.

MMC CORP’s net profit climbed 121% to RM105.89m in 3QFY16, mainly due to the consolidation of NCB’s earnings and a one-off land sale gain.

Favourable market response to Perodua’s Bezza lifted MBMR’s net profit for 3QFY16, which grew 147% to RM21.3m.

PARKSON posted its 4th straight quarterly loss in 1QFY17 amid weak consumer sentiment, with a net loss of RM62.57m (5.93 sen loss/share).

GENP’s net profit for 3QFY16 climbed 160% y-o-y to RM97.78m, as it saw stronger palm product selling prices.

Sources: theedgemarkets.com ; thestar.com

TradetheHotstocks, [24.11.16 07:00]

24th November,2016 Overnight Markets Roundup

By SARA H’NG/ALAN TAN

US MARKET

DJIA : 19,083.18 (+59.31)

S&P500 : 2,204.72 (+1.78)

NASDAQ : 5,380.68 (-5.67)

VIX : 12.43 (+0.02)

Dow and S&P 500 eked out record high ahead of the Thanksgiving holiday, helped by gains in industrial stocks, though losses in technology shares limited the advance and weighed on the Nasdaq.

US two-year Treasury yields and the dollar hit multi-year peaks after upbeat US economic data reinforced expectations for interest rate hikes.

EUROPE/UK MARKET

FTSE : 6,817.71 (-2.01)

DAX : 10,662.44 (-51.41)

CAC 40 : 4,529.21 (-19.14)

European shares steadied, with basic resources companies underpinning the broader market following a rise in metals prices.

CHINA/HK MARKET

SHANGHAI : 3,241.47 (-6.88)

HSI : 22,676.69 (-1.38)

China stocks consolidating recent gains with lower-valuation targets in banking and properties sectors still preferred by investors.

HK shares held steady, helped by Chinese money flowing into the city as the yuan weakened further.

JAPAN MARKET

Nikkei : Closed

M’SIA MARKET

KLCI : 1,630.38 (+1.06)

KLCI rose 0.1% on plantation share gains amid a weakening ringgit. Bank Negara Malaysia’s decision to maintain the OPR at 3% was also seen supporting the KLCI.

⬆️238⬇️547↔️321

OIL

WTI : 47.95

Brent : 48.95

Oil prices cut early losses after Iraq said it was willing to “shoulder responsibility” for some of OPEC’s planned production cuts and as US government data showed crude inventories fell last week.

GOLD

GOLD : 1,187.50

Gold slid to 9-mth low as a buoyant dollar extended its rally on the back of strong US data that further cemented a case for increasing interest rates next month.

FX & BONDS

USD/MYR : 4.4000

EUR/MYR : 4.6438

GBP/MYR : 5.4726

AUD/MYR : 3.2480

HKD/MYR : 0.5673

SGD/MYR : 3.0710

USD/JPY : 112.53

Msia 10 yr Bond Yield : 4.307%

US 10 yr Bond Yield : 2.355%

23/11 BURSA TRADE STAT

Retail (15.5%) – net BUY RM61.56M

Institution (61.2%) – net BUY RM98.83M

Foreign (23.3%) – net SELL RM160.39M

Total traded value RM1.825B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

+++++++++++=

BursaKakis Channel , [23.11.16 19:32]

BKs Technical Ideas 24/11/2016

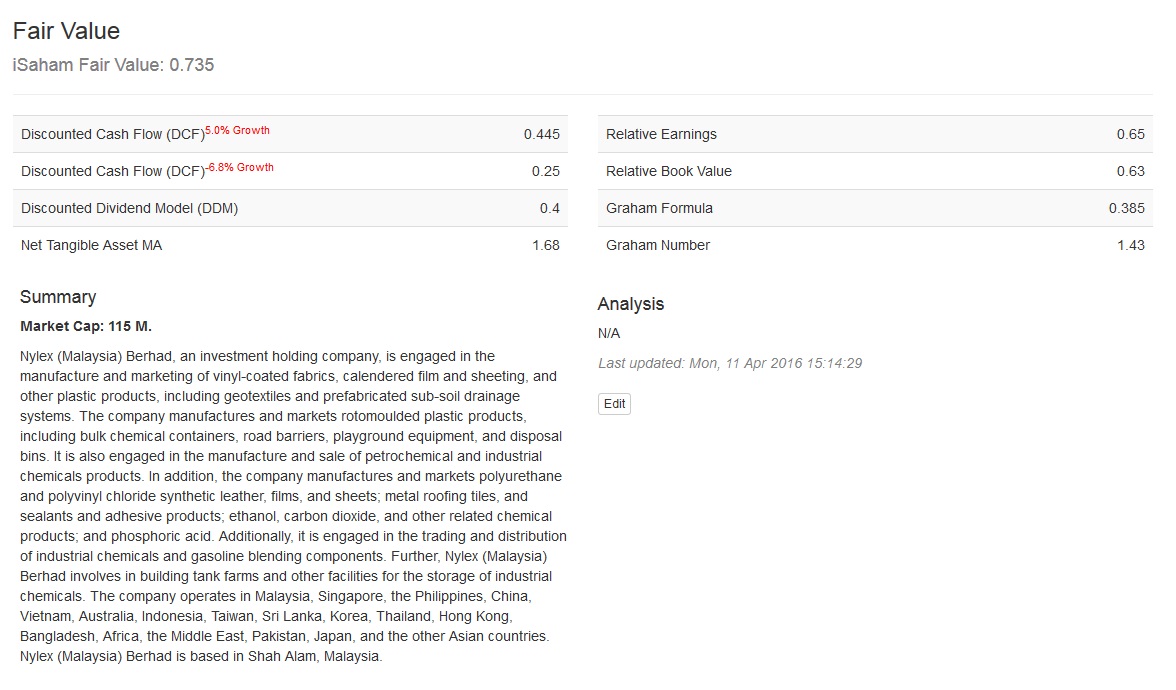

1) Nylex

2) Dufu

3) Mmsv

Kindly refer to charts posted in BKs Channel.

Our Telegram Link: telegram.me/bursakakis

Our Facebook Link : https://www.facebook.com/groups/192414771167397/

DISCLAIMER: The comments here are for sharing and learning purposes and do not represent a recommendation to buy or sell. Kindly consult your remisiers or dealers before you take any action. Thank you.

++++++++++++=

Logic Trading Analysis Channel, [23.11.16 19:46]

BURSA MALAYSIA MARKET IDEAS (24/11/2016):

FBMKLCI WHEN CAN SEE LIGHT OF TUNNEL

Dear All,

The FBMKLCI closed higher at +1.06 point or +0.07% to close at 1630.38.

FBMKLCI sideways at bottom have some support but overall stock remain very weak and lack of buying demand.

DJIA break 19000, possible to correction down anytime, if correction, hopefully not impact to our market too much.

Market move terribly, only can wait patiently and take time to study all the results to see which will be potential stock in coming days.

Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

Greed does not rest until it is satisfied and greed is never satisfied this Thursday! !

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

Views – 271

Corporate news:

Felda Global Ventures Holdings Bhd (FGV), which is expecting to end financial year 2016 (FY16) in the red after its third-quarter net loss widened, said it would rationalise its operations, which could lead to financial impairments and losses. (Financial Daily)

Brahmal Vasudevan, the founder and chief executive officer of private equity firm Creador Sdn Bhd, has emerged as a substantial shareholder of information and communications technology training and certification provider Prestariang Bhd. According to a filing with Bursa Malaysia, Brahmal acquired 24.5m shares or a 5.076% direct stake in Prestariang on Monday. (Financial Daily)

The Education Ministry denied allegations by several parties that the 1BestariNet project, which was implemented by a YTL Power’s subsidiary, was a failure. Its Minister Datuk Seri Mahdzir Khalid said the execution of the project in most schools was delayed based on the contract schedule as the issue of construction approval involved many local authorities. (Bernama)

Natural rubber glove maker Top Glove Corporation Bhd will continue to expand its research and development (R & D) to further improve the quality of its products and productivity. (Starbiz)

Loss-making Yen Global Bhd, in which Green Packet Bhd bought a 22% stake this year, is proposing a rights issue of up to 275m shares with an indicative issue price of 20 sen per share, which could raise up to RM55m. (Financial Daily)

E.A. Technique Bhd (Eatech) has entered into conditional sale and purchase agreement with MTC Engineering Sdn Bhd to acquire topside equipment currently attached to Eatech’s vessel for US$24m (RM106.4m). (Starbiz)

Supermax Corp Bhd expects its profit margin for financial year ending 30 June 2017 to rise by between 9% and 11%, given the growing demand for rubber gloves, consumption of contact lenses and through distribution of products. (Starbiz)

Signature International Bhd has signed a memorandum of understanding (MoU) with Bank Kerjasama Rakyat Malaysia Bhd (Bank Rakyat) for the provision of financing facilities to customers who are interested in buying kitchen equipment and appliances. (Financial Daily)

+++++++++++++

BursaKakis Channel , [23.11.16 09:36]

23Nov16

Dow Jones: 19,023.87 pts (+67.18pts, +0.35%)

Wall Street extended their gains as the Dow topped the 19,000 psychological level for the first time, owing to the better-than-expected housing data coupled with the rally in metal shares.

FBM KLCI: 1,629.32 pts (+2.04pts, +0.13%)

The FBM KLCI closed higher for the second straight session after foreign funds selling pressure were seen easing. The immediate resistance level is located around the 1,645 level.

Crude Palm Oil: RM2,928 (+RM9, +0.31%)

Crude palm oil prices edged higher, as the weakness in Ringgit spurred the demand. The RM3,000 level will serve as the immediate resistance level.

WTI Crude Oil: $48.03 (+$0.60, +1.26%)

Crude oil prices rose for the third straight session ahead of the OPEC meeting next week. Crude oil prices might head towards the US$50 level.

Gold: $1,212.32 (-$1.91, -0.16%)

Gold prices retreated ahead of the US Fed minutes meeting which could signal an interest rate hike next month. The US$1,200 level will serve as the immediate support level.

Economic Releases:

MY – Malaysia’s Interest Rate Decision – 23Nov16, 3.00PM

US – US’ October Durable Goods Orders – 23Nov16, 9.30PM

US – US’ New Home Sales – 23Nov16, 11.00PM

Bursa Malaysia Trade Statistics – 22Nov16

Institutions: Net BUY 72.8 mln (56.4%)

Retail: Net BUY 19.2 mln (14.8%)

Foreign: Net SELL 92.0 mln (28.8%)

Potential Momentum Stocks – 23Nov16

Stock Name: PRESTAR (9873)

Entry: Buy above RM0.625

Target: RM0.685 (9.6%), RM0.75 (20.0%)

Stop: RM0.585 (-6.4%)

Shariah: Yes

Technical: Symmetrical triangle breakout

Stock Name: RSAWIT (5113)

Entry: Buy above RM0.535

Target: RM0.585 (9.3%), RM0.61 (14.0%)

Stop: RM0.505 (-5.6%)

Shariah: Yes

Technical: Monitor for breakout

Source: Bloomberg, M+ Online

++++++++++++++

Uob Kay Hian Daily Top Pick, 23 Nov 2016

Raya, 0080

Close, 0.20

Breakout, 0.21

Buy TP, 0.27, 0.295

Support, 0.17

SL, 0.165

Time Frame, 2 Weeks to 2 Months

Dayang, 5141

Close, 0.91

Breakout, 0.92

Buy, TP, 1.11, 1.21

Support, 0.79

SL, 0.785

Time frame 2 weeks to 2 months

Bstead, 2771

Close, 2.17

Breakout, 2.21

Buy TP, 2.44, 2.59

Support, 2.09

SL, 2.08

Time frame, 2 weeks to 3 months

Thanks

++++++++++++=

Maybank Kim Eng Daily Kopi (22 November 2016)

Dow 19023.87 0.35%

S&P 2202.94 0.22%

Nasdaq 5386.35 0.33%

VIX 12.41 -0.08%

Nikkei 18162.94 0.31%

KOSPI 1983.47 0.89%

SSE 3248.35 0.94%

TWSE 9133.39 1.02%

HSI 22678.07 1.43%

STI 2822.2 0.20%

KLCI 1629.32 0.13%

USD/MYR 4.4210 -0.03%

EUR/MYR 4.709 -0.05%

GBP/MYR 5.5229 -1.20%

AUD/MYR 3.2746 -0.68%

SGD/MYR 3.1108 -0.26%

JPY/MYR 3.981 0.20%

(+/- chg refers to MYR relative perf)

Top U.S.Market News:

o US stocks keep going; Major indexes top milestones: Dow ends above 19,000 for first time ever, S&P ends above 2,200

o Investors keep pouring into riskier assets on speculation growth will accelerate.

o Dow, S&P 500, Nasdaq, and Russell 2000 all end at records for second straight day. Telecom and consumer discretionary the strongest sectors of the day

o Russell 2000 up 13 days in a row – the longest streak since February 1996.

o European markets marched higher, helped by mining stocks and financials

o Mitt Romney now seen as the leading candidate for State Secretary under President Trump – press

Stock News

o Gains were broad-based, with nine of the 11 main S&P sectors ending higher, led by consumer discretionary (+1.2%) and industrials (+0.5%); only health care (-1.4%) and energy (flat) finished out of the green, as WTI crude finished 0.4% lower at $48.07/bbl.

o Steel names U.S. Steel (X +11.4%), AK Steel (AKS +10.7%), Steel Dynamics (STLD +4.1%), Nucor (NUE +4.4%) and Commercial Metals (CMC +4.7%) all surge to 52-week highs.

o Three days before the busiest shopping day of the year, companies tracked by the Standard & Poor’s 1500 Retail Index surged 1.7% to an all-time high

o Vale (VALE) +7% following news that Indonesia will cut the royalty charged on sales of processed and refined nickel to 2% from 4%, a step the government hopes will encourage more miners to develop smelters.

o Analog Devices (ADI) shares jump 4.5% after beating est’s; FQ4 EPS of $1.05 beats by $0.16. Revenue of $1B (+2.2% Y/Y) beats by $57.42M.

o Disney (DIS) To embark on multi-year $1.4B expansion of theme park in Hong Kong

o HP (HPQ): FQ4 EPS of $0.36 in-line. Revenue of $12.5B (+1.9% Y/Y) beats by $620M.

Notable ADR News:

o Vipshop (VIPS -14.5%) shares get pummeled after revenue miss due to lower than expected active users growth. Shares were under pressure but selling accelerated on strong volume this afternoon.

o MACAU: Macau 3Q GDP rises 4% YoY- First Q expansion in 2 years

-3 Crown Resorts employees formally arrested (moved from detained status)

-Jewelry retailer proxy from Macau consumer Chow Tai Fook report 7-8 store closures in Macau/China

-Macau/HK SSS drop 26% YoY

-MGM China underperformed, gave back some of the 7% gain yesterday on CS upgrade

o Cognizant (CTSH -3.6%) BofAML cuts CTSH to Underperform from Buy, PT: $48 from $66- citing risk on US immigration reform and slower growth makes firm cautious near-term

o SINA shares +10%; 3Q Adj. EPS Beats Est. PT lowered to $121 from $123 at JPMorgan, maintains Overweight rating

o Weibo (WB) jumps 7% after Q3 results beat estimates and guided Q4 net rev higher. JPMorgan making positive comments; Reiterates Overweight rating, PT raised to $74 from $70 – Firm believes Weibo will continue to capture advertisers budget allocation in the next couple of years

o YY Price Target lowered to $60 from $67 at JPMorgan, maintains Overweight rating- citing music business slowdown

o 58.com (WUBA) Tencent reports 26% stake, down from 28.2%

* VIX: -0.08% to 12.41

* Volume 7.2B, 3% above the 3-month daily avg

* Treasury curve steepened modestly today after plunging for 10 days. The two-year yield finishing flat at 1.08% while the yield on the 10-year note slipped a basis point to 2.31%.

30-year -0.12%. 10-yr +0.02%. 5-yr +0.01%.

European Equity Highlights

STOXX 600 +0.23% 341.02

DAX +0.27% 10713.85

FTSE +0.62% 6819.72

CAC +0.41% 4548.35

* European markets marched higher, helped by mining stocks and financials

Forex

DXY 0.00% 101.05

Euro -0.06% vs. dollar. Yen +0.22%. Pound +0.61%.

*The DXY Index which had rallied for 10 consecutive sessions through Monday, ended basically unchanged today.

* MYR: ringgit was fractionally lower after reversing sharper losses earlier. MYR had dropped to 4.44, the lowest since September 2015. USD rally seems to be running out of steam ahead of US holiday weekend. MYR has lost nearly 5% since Nov 9 following the US elections and after the central bank clamped down on offshore ringgit trading.

Commodities:

CPO: +9 +0.10% 2928

* Palm oil extends gains, tracking stronger soy oil. Futures +18% YTD

For stock ideas and market flows, access Market Insight on Maybank Investment Bank http://bit.ly/1dsTxV9 and Maybank KE Trade SG mobile apps https://appsto.re/us/OY-Kw.i.

Download from Apple Store and Google Play now.

++++++++++++++++++=

investment consultant:

Bursa Malaysia Stocks

Wednesday 23/11/2016

Latest Currency exchange is RM4.40

Dear investors and traders, Hot STOCK PICKS FOR TOMORROW !!

Based on Emico result sentiment , here are the stocks recommendation :

1) Johotin – Excellent result , 1st TP RM1.5 , just join the party, every selling to bids is an opportunity for you to enter. Whoever has johotin shares, can try average up.

2) Biohldg – Good result but difficult to trade, try to trade at break up point.

3) Priva – slightly above average result, less popular stock, trade only if you are confident with it.

4)inno- result very good but already up so much, recommended by other people group, sell on news or jump in, its up to you.

Other than these three, there is nothing special about other companies result.

+++++++++++++++++

Dzulhilman M+ WM PR Traders:

Salam and Morning All

MACRO : Wall Street’s three main stock indexes hit record highs for a second straight day on Tuesday before trimming gains, while European shares also rose on expectations that markets would benefit from U.S. President-elect Donald Trump’s policies (investing. com).

MICRO : Market closed on positive notes yesterday. First session started off sluggish and ended active towards closing of the market. BNM intervene Ringgit from falling further. The next question would be how long and how strong can BNM protect Ringgit? Technically Ringgit has reached end of wave 5 of EW and should strenghtens from here onwards.

WHAT TO EXPECT? : We are not out of the woods yet. Selected counters shall be in play but generally market is cautious. Short term trading is ok as quater reports are coming in. Metal counters particularly has been maintaining support despite though market scene which makes them interesting to be in trading list.

Below are my Watch List for SWING counters (23/11/2016)

PRESTAR

EP : ABOVE 0.640

SL : BELOW 0.620

TP : 0.680/0.725

PECCA

EP : ABOVE 1.800

SL : BELOW 1.750

TP : 2.070

Happy trading.

=========================================================

# Interested to become a Remisier with MPlus? Come and talk to us now!!

#FYI we have 3 types of buycalls:

1 – SWING : Given every early morning such as above.

2 – CONTRA : Given in VIP Group before closing of market.

3 – INTRADAY : Live buy call during market operation in VIP Group.

#tepukdadatanyaselera

++++++++++++++

TradetheHotstocks, [23.11.16 07:06]

Market News Roundup

1⃣ Brahmal Vasudevan, the founder and CEO of private equity firm Creador SB, has emerged as a substantial shareholder of ICT training and certification provider PRESTARIANG.

2⃣ Loss-making YEN, in which GPACKET bought a 22% stake this year, is proposing a rights issue of up to 275m shares with an indicative issue price of 20sen per share, which could raise up to RM55m.

Financial Result Highlight

FGV saw its net loss widen to RM94.87m (2.6 sen/share) in 3QFY16, largely due to lower CPO production, higher raw sugar costs as well as lower earnings from downstream segment.

AAX registered its fourth consecutive profit in 3QFY16, with a net profit of RM11.03m. This is mainly due to increase in scheduled flight revenue, growth in ancillary income and rise in aircraft operating lease income.

HUAT LAI posted a 244% surge in net profit to RM45.2m (57.89 sen/share) in 3QFY16, due to higher revenue and stricter cost controls.

IOI PROP’s net profit grew 64.2% to RM189.57m (4.3 sen/share) in 1QFY17, mainly attributed to better revenue from property segments and leisure and hospitality segment.

JOHOTIN’s net profit more than tripled to RM10.79m (7.85 sen/share) in 3QFY16 due to higher sales, lower material costs and forex gain on financial settlement.

SALCON slipped into the red with a net loss of RM755k (0.11 sen/share) in 3QFY16, its quarterly performance was dragged by its other income.

DIALOG’s net profit climbed 35% y-o-y to RM81.33m in 1QFY17, on higher contribution from its JV, particularly the Pengerang Independent Terminals which has fully leased out its storage capacity.

Sources: theedgemarkets.com ; thestar.com

TradetheHotstocks, [23.11.16 07:08]

23rd November,2016 Overnight Markets Roundup

US MARKET

DJIA : 19,023.87 (+67.18)

S&P500 : 2,202.94 (+4.76)

NASDAQ : 5,386.35 (+17.49)

VIX : 12.41 (-0.01)

US stocks extended all-time highs, with the Dow topping 19,000 for the first time and small caps clocking the longest rally in 20 years, as investors poured into riskier assets on speculation growth will accelerate.

EUROPE/UK MARKET

FTSE : 6,819.72 (+41.76)

DAX : 10,713.85 (+28.72)

CAC 40 : 4,548.35 (+18.77)

Gains in miners pushed European equities to their highest levels in almost a month, mitigating a drag from drugmakers.

CHINA/HK MARKET

SHANGHAI : 3,249.58 (+31.43)

HSI : 22,678.07 (+320.29)

China stocks advanced, helped by a strong rally in blue-chips, in particular financial and energy shares, after US exchanges rose.

JAPAN MARKET

Nikkei : 18,162.94 (+56.92)

Japanese stocks extended their winning streak as a rally in oil companies overshadowed concerns following a magnitude 7.4 earthquake off the coast of Fukushima.

M’SIA MARKET

KLCI : 1,629.32 (+2.04)

KLCI climbed 0.1% as foreign investors turned into net buyers of Malaysian shares. Crude oil gains also contributed to the KLCI’s rise.

⬆️344⬇️410↔️366

By SARA H’NG/ALANTAN

OIL

WTI : 47.91

Brent : 49.12

Oil closed near $48 a barrel in New York after an OPEC committee failed to agree on Iranian and Iraqi production levels.

GOLD

GOLD : 1,211.50

Investors cut holdings in gold exchange-traded products, amid speculation that the Federal Reserve will raise US interest rates next month.

FX & BONDS

USD/MYR : 4.4200

EUR/MYR : 4.6971

GBP/MYR : 5.4900

AUD/MYR : 3.2721

HKD/MYR : 0.5699

SGD/MYR : 3.1027

USD/JPY : 111.10

Msia 10 yr Bond Yield : 4.339%

US 10 yr Bond Yield : 2.314%

22/11 BURSA TRADE STAT

Retail (14.8%) – net BUY RM19.14M

Institution (56.4%) – net BUY RM72.87M

Foreign (28.8%) – net SELL RM92.01M

Total traded value RM1.811B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

TradetheHotstocks, [23.11.16 07:10]

[ Photo ]

+++++++++++++++=

BKs Technical Ideas 23/11/2016

1) Mmsv

2) IJacobs

3) Krono

4) Vis (Ideas @ RM0.235 on 20/11/16)

Kindly refer to charts posted in BKs Channel.

Our Telegram Link: telegram.me/bursakakis

Our Facebook Link : https://www.facebook.com/groups/192414771167397/

DISCLAIMER: The comments here are for sharing and learning purposes and do not represent a recommendation to buy or sell. Kindly consult your remisiers or dealers before you take any action. Thank you.

++++++++++++++++

Logic Trading Analysis Channel, [22.11.16 21:00]

BURSA MALAYSIA MARKET IDEAS (23/11/2016):

FBMKLCI FAIL TO EXCITED WITH WORLD BULL

Dear All,

The FBMKLCI closed higher at +2.04 point or +0.13% to close at 1629.32.

FBMKLCI remain soft, while whole world rebound trend positive. Do not give up, we may still see some light from the tunnel for today.

DJIA ready to break 19000, Yes, Trump effect is strong, and we need someone like TRUMP in Malaysia in order to make Malaysia Boleh Again !

Yesterday a lot company posting result, not much exciting.

In our Premium Groups, we start to commenting on company’s result, one of the company have been mention potential FIFO yesterday like EMICO doing well.

Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

People are blind to reality and only see what they want to see this Wednesday !

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

Views – 277

Analisis 25/11/2016

+++++++++++++++++

BursaKakis Channel :

M+ Online Morning Buzz – 25Nov16

Dow Jones: 19,083.18 pts (+59.31pts, +0.31%)

U.S. stockmarkets was closed for Thanksgiving public holiday. The Dow ended at its all-time high 19,083.18 level on its previous session.

FBM KLCI: 1,624.21 pts (-6.17pts, -0.38%)

The FBM KLCI halted a three straight session of gains as profit taking activities emerged in selective index heavyweights whilst foreign funds continue to trim their holdings. The immediate support level is located around the 1,610 level.

Crude Palm Oil: RM3,004 (+RM50, +1.69%)

Tracking the sharp gains in soybean oil prices, crude palm oil prices rallied but pared most of its intraday gains, before closing above the RM3,000 psychological level. The RM3,100 level will serve as the next resistance level.

WTI Crude Oil: $47.96 (-$0.05, -0.10%)

Crude oil prices trended sideways as investors anticipate for the OPEC meeting for a potential output cut next week. Crude oil prices might head towards the US$50 level.

Gold: $1,181.67 (-$2.83, -0.24%)

Gold prices retreated after the US Dollar continues to strengthen against a basket of currencies. The US$1,150 level will serve as the next support level.

Economic Releases:

MY – Malaysia’s October Inflation Rate – 25Nov16, 12.00PM

Bursa Malaysia Trade Statistics – 24Nov16

Institutions: Net BUY 161.9 mln (62.4%)

Retail: Net BUY 6.8 mln (17.6%)

Foreign: Net SELL 168.7 mln (20.0%)

Potential Momentum Stocks – 25Nov16

Stock Name: CYPARK (5184)

Entry: Buy above RM2.25

Target: RM2.54 (12.9%), RM2.73 (21.3%)

Stop: RM2.09 (-7.1%)

Shariah: Yes

Technical: Monitor for breakout

Stock Name: KAREX (5247)

Entry: Buy above RM2.64

Target: RM2.74 (3.8%), RM2.90 (9.8%)

Stop: RM2.53 (-4.2%)

Shariah: No

Technical: Monitor for breakout

Source: Bloomberg, M+ Online

Uob Kay Hian Daily Top Pick, 25 Nov 2016

Mieco, 5001

Close, 1.23

Buy TP, 1.33, 1.47

Support, 1.12

SL, 1.11

Time Frame, 2 Weeks to 2 Months

Mfcb, 3069

Close, 2.36

Buy, TP, 0 2.54, 2.61

Support, 2.17

SL, 2.16

Time frame 2 weeks to 2 months

Jtiasa, 4383

Close, 1.43

Breakout, 1.47

Buy TP, 1.60, 1.68

Support, 1.30

SL, 1.29

Time frame, 2 weeks to 2 months

Thanks

Note : The Offeror has recd more than 90 % of voting shares of Huat Lai on 23/11/2016 & shall suspend trading of the Huat Lai Shares upon the expiry of five (5) market days from 7 December 2016, being the closing date of the Offer .

Innoprise or Cepat ?

1) Inno Q eps 2.88 cts, forward pe 10 = RM1.15

2) Cepat Q eps 3.37 cts, forward pe 10 = RM1.35

Our Link: telegram.me/bursakakis

+++++++++++++++++

TradetheHotstocks:

Market News Roundup

1⃣ AIRASIA said bids are coming in for its leasing arm Asia Aviation Capital Ltd, worth some US$1b, with eventual sale of the unit to take place in early 2017.

Financial Result Highlight

GENTING saw its net profit rise 60% y-o-y to RM577.21m (15.5 sen/share) in 3QFY16, mainly due to lower net fair value loss on derivative financial instruments and lower impairment losses.

MAGNUM ‘s net profit rose 44.9% to RM55.02m (3.87 sen/share) in 3QFY16, as prizes payout for its gaming segment was lower in the current quarter.

AEON’s net profit fell sharply by 81.95% to RM5.42m (0.39 sen/share) in 3QFY16, on higher operating costs, new store and malls expense and higher interest expense.

IHH’s net profit for 3QFY16 increased by 46.3% to RM173.3m. This was after forex losses on Acibadem Holdings non-Turkish Lira borrowings narrowed significantly over the year.

KNM’s net profit slipped 52.69% to RM1.12m (0.05 sen/share) in 3QFY16, due to loss incurred in its Americas segment.

JAKS said its net profit jumped 134% to RM13.86m (3.16 sen/share) for 3QFY16. The group said its construction division was the main driver of profit growth for the quarter.

MAYBANK said it had cut its loan growth projection for the current FY, after posting net profit for the quarter was RM1.795b, 5.4% lower.

AXIATA reported a 71% fall in 3Q net profit at RM256.56m, on higher operating cost. Weaker financials from its Malaysia and Indonesia units also contributed to the group’s lower net profit.

Sources: theedgemarkets.com ; thestar.com

25th November, 2016 Markets Roundup

US MARKET

Closed

EUROPE/UK MARKET

FTSE : 6,829.20 (+11.49)

DAX : 10,689.26 (+26.82)

CAC 40 : 4,542.56 (+13.35)

European shares edged up, remaining within a recent range, as a boost from healthcare stocks was partly offset by weak telecoms and utilities.

CHINA/HK MARKET

SHANGHAI : 3,241.49 (+0.35)

HSI : 22,608.49 (-68.20)

China’s blue-chip index rose as investors chased cyclical stocks, but the broader market struggled for traction with growth stocks under persistent selling pressure.

JAPAN MARKET

Nikkei : 18,333.41 (+170.47)

Nikkei share average rose helped by hopes for better exporters’ earnings as the dollar jumped against the yen.

M’SIA MARKET

KLCI : 1,624.21 (-6.17)

Blue chips closed lower as Axiata came under selling pressure after its results while the RM slumped to a Sept2015 low against the strong USDF.

OIL

WTI : 47.98

Brent : 48.88

Oil prices were little changed as uncertainty ahead of a planned OPEC-led crude production cut and thin liquidity during the US Thanksgiving holiday kept traders from making big new bets.

GOLD

GOLD : 1,183.50

Gold steadied as the dollar retreated slightly from an almost 14-year high hit on positive US economic data.

FX & BONDS

USD/MYR : 4.4425

EUR/MYR : 4.6882

GBP/MYR : 5.5324

AUD/MYR : 3.2918

HKD/MYR : 0.5727

SGD/MYR : 3.1016

USD/JPY : 113.35

Msia 10 yr Bond Yield : 4.331%

US 10 yr Bond Yield : 2.355%

24/11 BURSA TRADE STAT

Retail (17.6%) – net BUY RM6.9M

Institution (62.5%) – net BUY RM161.9M

Foreign (19.9%) – net SELL RM168.8M

Total traded value RM1.269B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

++++++++++++++++++

BursaKakis Channel :

BKs Technical Ideas 25/11/2016

1) Cepat (Live call @ 0.88 on 24/11/16)

2) Thplant

Kindly refer to charts posted in BKs Channel.

Our Telegram Link: telegram.me/bursakakis

Our Facebook Link : https://www.facebook.com/groups/192414771167397/

DISCLAIMER: The comments here are for sharing and learning purposes and do not represent a recommendation to buy or sell. Kindly consult your remisiers or dealers before you take any action. Thank you.

Good Quarter Results 24/11/2016

1) AirAsia

2) Tguan

3) Jhm

4) Prestar

5) Kesm

BKs

++++++++++

TradetheHotstocks:

Majlis Penasihat Syariah (MPS) Suruhanjaya Sekuriti Malaysia (SC) telah meluluskan senarai kemaskini sekuriti yang diklasifikasikan sebagai sekuriti patuh Syariah yang tersenarai di Bursa Malaysia, berkuat kuasa mulai 25 November 2016.

34 saham-saham baru yang patuh syariah.

1. Advance Synergy Bhd

2. Amcorp Properties Bhd

3. Analabs Resources Bhd

4. AYS Ventures Bhd

5. BCM Alliance Bhd

6. Brite-Tech Bhd

7. BTM Resources Bhd

8. Dancomech Holdings Bhd

9. Eastland Equity Bhd

10. Eversendai Corporation Bhd

11. Ewein Bhd

12. Goodway Integrated Industries Bhd

13. HeiTech Padu Bhd

14. IRIS Corporation Bhd

15. Jiankun International Bhd

16. Karambunai Corp Bhd

17. LCTH Corporation Bhd

18. Leader Steel Holdings Bhd

19. Lien Hoe Corporation Bhd

20. Magna Prima Bhd

21. Meda Inc. Bhd

22. Mega Sun City Holdings

23. Mexter Technology Bhd

24. ML Global Bhd

25. mTouche Technology Bhd

26. MWE Holdings Bhd

27. P.I.E. Industrial Bhd

28. Pensonic Holdings Bhd

29. Perak Transit Bhd

30. Petron Malaysia Refining & Marketing Bhd

31. Reliance Pacific Bhd

32. Tadmax Resources Bhd

33. WCE Holdings Bhd

34. Willowglen Bhd

±++++++++++++

Logic Trading Analysis Channel:

BURSA MALAYSIA MARKET IDEAS (2511/2016):

FBMKLCI STRONG COMPANY STILL EXIST IN BURSA

Dear All,

The FBMKLCI closed lower at -6.17 point or -0.38% to close at 1624.21.

FBMKLCI sideways at bottom have some support but overall stock remain very weak and lack of buying demand. At least yesterday some company posting good result.

DJIA remain superbull, we hope to see it continue next month if FED increase interest rate. As long as DJIA strong, sooner or later our stock market will be recovering.

Be proud for some of our Malaysia Brand like AIRASIA, GENTING, there are doing very well, and potentially in ten years to come become super star in BURSA.

I hope to see AIRASIA back to RM 3.00 as soon as possible.

Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

Spend life with who makes you Happy not who you have to Impress this Friday ! !

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

Views – 351