Dow Theory – Trends

Dow recognized that trends changed when the pattern of peaks and troughs reversed.

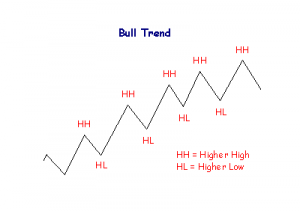

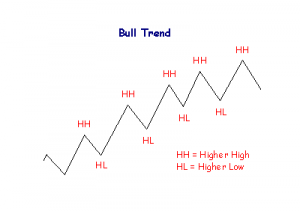

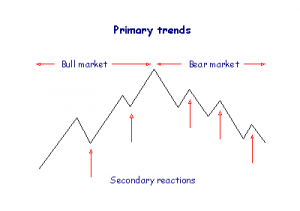

Bull Trends

A bull trend is identified by a series of rallies where each rally exceeds the highest point of the previous rally. The decline between rallies ends above the lowest point of the previous decline. A series of successive higher highs and higher lows.

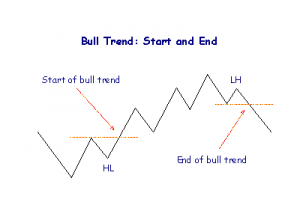

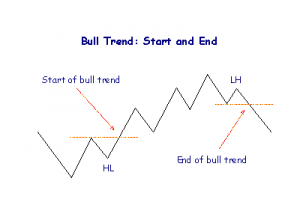

The start of an up trend is signaled when price makes a higher low (trough), followed by a rally above the previous high(peak):

Start = higher Low + break above previous High.

The end is signaled by a lower high (peak), followed by a decline below the previous low (trough):

End = lower High + break below previous Low.

What if the series of higher Highs and higher Lows is first broken by a lower Low? There are two possible interpretations – see Large Corrections.

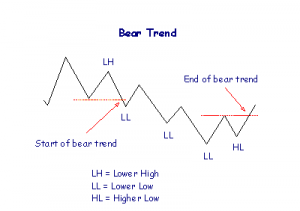

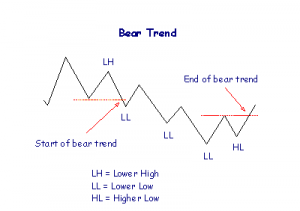

Bear Trends

Each successive rally fails to penetrate the high point of the previous rally. Each decline terminates at a lower point than the preceding decline. A series of successive lower highs and lower lows.

A bear trend starts at the end of a bull trend: when a rally ends with a lower peak and then retreats below the previous low. The end of a bear trend is identical to the start of a bull trend.

What if the series of lower Highs and lower Lows is first broken by a higher High? This is a gray area – see Large Corrections below.

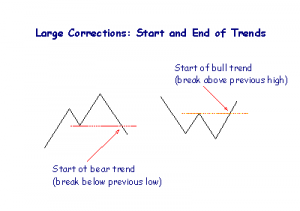

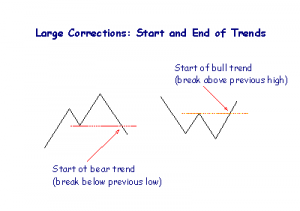

Large Corrections

A large correction occurs when price falls below the previous low (during a bull trend) or where price rises above the previous high (in a bear trend).

Some purists argue that a trend ends if the sequence of higher highs and higher lows is broken. Others argue that a bear trend has not started until there is a lower High and Low nor has a bull trend started until there is a higher Low and High.

For practical purposes, only accept large corrections as trend changes in the primary trend.

- A bull trend starts when price rallies above the previous high;

- A bull trend ends when price declines below the previous low;

- A bear trend starts at the end of a bull trend (and vice versa).

Trend Changes

A trend should always be treated as intact until there is a clear signal that the opposite trend has started.

Views – 1822

Recent Comments