Views – 271

BursaKakis Channel :

Uob Kay Hian Daily Top Pick, 24 Nov 2016

Ghlsys, 0021

Close, 0.83

Breakout, 0.855

Buy TP, 0.985, 1.04

Support, 0.78

SL, 0.775

Time Frame, 2 Weeks to 2 Months

Insas, 3379

Close, 0.72

Breakout, 0.755

Buy, TP, 0.82, 0.875

Support, 0.69

SL, 0.685

Time frame 2 weeks to 2 months

Leonfb, 5232

Close, 0.515

Breakout, 0.525

Buy TP, 0.59, 0.61

Support, 0.48

SL, 0.475

Time frame, 2 weeks to 2 months

Thanks

+++±+++++++

[Forwarded from Itchy Itchy Trader Club (J C)]

M+ Online Morning Buzz – 24Nov16

Dow Jones: 19,083.18 pts (+59.31pts, +0.31%)

U.S. stockmarkets crept higher as Dow (+0.3%) closed at a fresh record high, boosted by industrial shares ahead of the Thanksgiving public holiday.

FBM KLCI: 1,630.38 pts (+1.06pts, +0.07%)

The FBM KLCI chalked in marginal gains yesterday, after reversing all its intraday losses on last minute buying support amongst selective plantation heavyweights. The immediate resistance level is located around the 1,645 level.

Crude Palm Oil: RM2,954 (+RM26, +0.89%)

Crude palm oil prices closed higher for the third consecutive session, tracking the gains in soybean oil which the latter saw an increase in biofuel mandate. The RM3,000 level will serve as the immediate resistance level.

WTI Crude Oil: $47.96 (-$0.02, -0.04%)

Crude oil prices closed marginally lower on doubts over the upcoming potential output cut could curb global supply glut. Crude oil prices might head towards the US$50 level.

Gold: $1,188.32 (-$24.00, -1.98%)

Gold prices extended its losses to its lowest level since February 2016 after the latest minutes meeting from the US Federal Reserve signals to an interest rate hike next month. The US$1,150 level will serve as the next support level.

Bursa Malaysia Trade Statistics – 23Nov16

Institutions: Net BUY 98.8 mln (61.2%)

Retail: Net BUY 61.5 mln (15.5%)

Foreign: Net SELL 160.3 mln (23.3%)

Potential Momentum Stocks – 24Nov16

Stock Name: MMCCORP (2194)

Entry: Buy above RM2.45

Target: RM2.66 (8.6%), RM2.80 (14.3%)

Stop: RM2.30 (-6.1%)

Shariah: Yes

Technical: Monitor for breakout

Stock Name: GHLSYS (0021)

Entry: Buy above RM0.82

Target: RM0.875 (6.7%), RM0.915 (11.6%)

Stop: RM0.80 (-2.4%)

Shariah: Yes

Technical: Short- term consolidation breakout

Source: Bloomberg, M+ Online

++++++++++++=

TradetheHotstocks, [24.11.16 06:58]

Malakoff, Bumi Armada, Ekovest, MMC Corp, AppAsia, Mercury Industries, Titijaya, MBM Resources, Parkson and Genting Plantations | The Edge Markets

http://www.theedgemarkets.com/en/article/malakoff-bumi-armada-ekovest-mmc-corp-appasia-mercury-industries-titijaya-mbm-resources

++++++++++++=

Market News Roundup

1⃣ TITIJAYA plans to enter the affordable housing segment with a proposed development worth RM2.4b in GDV in Bukit Raja, Selangor, in 2Q of 2017.

2⃣ EKOVEST said it is close to securing approximately RM400m more construction contracts for FY2017, which will boost its order book to over RM7b.

3⃣ APPASIA’s unit, EISB, has been appointed as Alibaba Cloud’s non-exclusive reseller to drive the sale of certain cloud and computing and technology products and services for the latter.

4⃣ MERCURY is exiting the auto refinish business due to increasing challenges in the segment from the slowing domestic economy, uncertainties in the global economies and the weaker RM.

5⃣ MALAKOFF has launched arbitration proceedings against Japan’s Sumitomo Corp, Zelan Hldgs SB & Sumi-Power Msia SB seeking RM785m for breach of contract.

Financial Result Highlight

ARMADA reported 3Q net loss of RM96.71m versus a net profit of RM70m a year earlier as the O&G support services provider registered lower revenue.

MMC CORP’s net profit climbed 121% to RM105.89m in 3QFY16, mainly due to the consolidation of NCB’s earnings and a one-off land sale gain.

Favourable market response to Perodua’s Bezza lifted MBMR’s net profit for 3QFY16, which grew 147% to RM21.3m.

PARKSON posted its 4th straight quarterly loss in 1QFY17 amid weak consumer sentiment, with a net loss of RM62.57m (5.93 sen loss/share).

GENP’s net profit for 3QFY16 climbed 160% y-o-y to RM97.78m, as it saw stronger palm product selling prices.

Sources: theedgemarkets.com ; thestar.com

TradetheHotstocks, [24.11.16 07:00]

24th November,2016 Overnight Markets Roundup

By SARA H’NG/ALAN TAN

US MARKET

DJIA : 19,083.18 (+59.31)

S&P500 : 2,204.72 (+1.78)

NASDAQ : 5,380.68 (-5.67)

VIX : 12.43 (+0.02)

Dow and S&P 500 eked out record high ahead of the Thanksgiving holiday, helped by gains in industrial stocks, though losses in technology shares limited the advance and weighed on the Nasdaq.

US two-year Treasury yields and the dollar hit multi-year peaks after upbeat US economic data reinforced expectations for interest rate hikes.

EUROPE/UK MARKET

FTSE : 6,817.71 (-2.01)

DAX : 10,662.44 (-51.41)

CAC 40 : 4,529.21 (-19.14)

European shares steadied, with basic resources companies underpinning the broader market following a rise in metals prices.

CHINA/HK MARKET

SHANGHAI : 3,241.47 (-6.88)

HSI : 22,676.69 (-1.38)

China stocks consolidating recent gains with lower-valuation targets in banking and properties sectors still preferred by investors.

HK shares held steady, helped by Chinese money flowing into the city as the yuan weakened further.

JAPAN MARKET

Nikkei : Closed

M’SIA MARKET

KLCI : 1,630.38 (+1.06)

KLCI rose 0.1% on plantation share gains amid a weakening ringgit. Bank Negara Malaysia’s decision to maintain the OPR at 3% was also seen supporting the KLCI.

⬆️238⬇️547↔️321

OIL

WTI : 47.95

Brent : 48.95

Oil prices cut early losses after Iraq said it was willing to “shoulder responsibility” for some of OPEC’s planned production cuts and as US government data showed crude inventories fell last week.

GOLD

GOLD : 1,187.50

Gold slid to 9-mth low as a buoyant dollar extended its rally on the back of strong US data that further cemented a case for increasing interest rates next month.

FX & BONDS

USD/MYR : 4.4000

EUR/MYR : 4.6438

GBP/MYR : 5.4726

AUD/MYR : 3.2480

HKD/MYR : 0.5673

SGD/MYR : 3.0710

USD/JPY : 112.53

Msia 10 yr Bond Yield : 4.307%

US 10 yr Bond Yield : 2.355%

23/11 BURSA TRADE STAT

Retail (15.5%) – net BUY RM61.56M

Institution (61.2%) – net BUY RM98.83M

Foreign (23.3%) – net SELL RM160.39M

Total traded value RM1.825B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

+++++++++++=

BursaKakis Channel , [23.11.16 19:32]

BKs Technical Ideas 24/11/2016

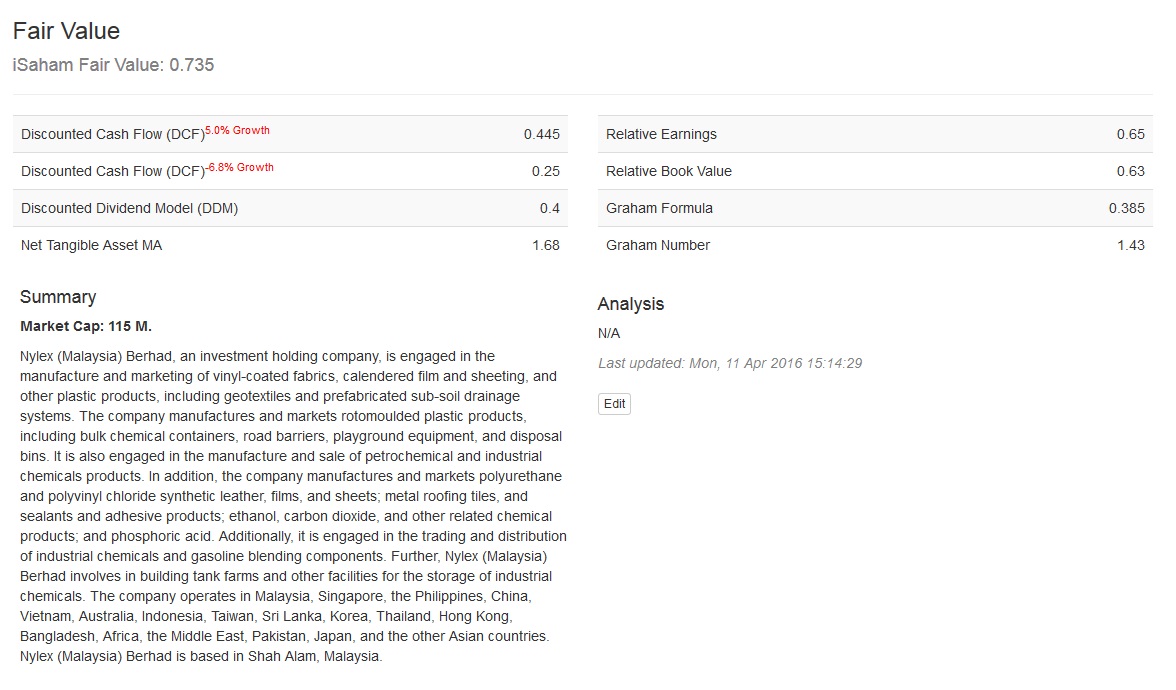

1) Nylex

2) Dufu

3) Mmsv

Kindly refer to charts posted in BKs Channel.

Our Telegram Link: telegram.me/bursakakis

Our Facebook Link : https://www.facebook.com/groups/192414771167397/

DISCLAIMER: The comments here are for sharing and learning purposes and do not represent a recommendation to buy or sell. Kindly consult your remisiers or dealers before you take any action. Thank you.

++++++++++++=

Logic Trading Analysis Channel, [23.11.16 19:46]

BURSA MALAYSIA MARKET IDEAS (24/11/2016):

FBMKLCI WHEN CAN SEE LIGHT OF TUNNEL

Dear All,

The FBMKLCI closed higher at +1.06 point or +0.07% to close at 1630.38.

FBMKLCI sideways at bottom have some support but overall stock remain very weak and lack of buying demand.

DJIA break 19000, possible to correction down anytime, if correction, hopefully not impact to our market too much.

Market move terribly, only can wait patiently and take time to study all the results to see which will be potential stock in coming days.

Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

Greed does not rest until it is satisfied and greed is never satisfied this Thursday! !

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

Views – 272

Corporate news:

Felda Global Ventures Holdings Bhd (FGV), which is expecting to end financial year 2016 (FY16) in the red after its third-quarter net loss widened, said it would rationalise its operations, which could lead to financial impairments and losses. (Financial Daily)

Brahmal Vasudevan, the founder and chief executive officer of private equity firm Creador Sdn Bhd, has emerged as a substantial shareholder of information and communications technology training and certification provider Prestariang Bhd. According to a filing with Bursa Malaysia, Brahmal acquired 24.5m shares or a 5.076% direct stake in Prestariang on Monday. (Financial Daily)

The Education Ministry denied allegations by several parties that the 1BestariNet project, which was implemented by a YTL Power’s subsidiary, was a failure. Its Minister Datuk Seri Mahdzir Khalid said the execution of the project in most schools was delayed based on the contract schedule as the issue of construction approval involved many local authorities. (Bernama)

Natural rubber glove maker Top Glove Corporation Bhd will continue to expand its research and development (R & D) to further improve the quality of its products and productivity. (Starbiz)

Loss-making Yen Global Bhd, in which Green Packet Bhd bought a 22% stake this year, is proposing a rights issue of up to 275m shares with an indicative issue price of 20 sen per share, which could raise up to RM55m. (Financial Daily)

E.A. Technique Bhd (Eatech) has entered into conditional sale and purchase agreement with MTC Engineering Sdn Bhd to acquire topside equipment currently attached to Eatech’s vessel for US$24m (RM106.4m). (Starbiz)

Supermax Corp Bhd expects its profit margin for financial year ending 30 June 2017 to rise by between 9% and 11%, given the growing demand for rubber gloves, consumption of contact lenses and through distribution of products. (Starbiz)

Signature International Bhd has signed a memorandum of understanding (MoU) with Bank Kerjasama Rakyat Malaysia Bhd (Bank Rakyat) for the provision of financing facilities to customers who are interested in buying kitchen equipment and appliances. (Financial Daily)

+++++++++++++

BursaKakis Channel , [23.11.16 09:36]

23Nov16

Dow Jones: 19,023.87 pts (+67.18pts, +0.35%)

Wall Street extended their gains as the Dow topped the 19,000 psychological level for the first time, owing to the better-than-expected housing data coupled with the rally in metal shares.

FBM KLCI: 1,629.32 pts (+2.04pts, +0.13%)

The FBM KLCI closed higher for the second straight session after foreign funds selling pressure were seen easing. The immediate resistance level is located around the 1,645 level.

Crude Palm Oil: RM2,928 (+RM9, +0.31%)

Crude palm oil prices edged higher, as the weakness in Ringgit spurred the demand. The RM3,000 level will serve as the immediate resistance level.

WTI Crude Oil: $48.03 (+$0.60, +1.26%)

Crude oil prices rose for the third straight session ahead of the OPEC meeting next week. Crude oil prices might head towards the US$50 level.

Gold: $1,212.32 (-$1.91, -0.16%)

Gold prices retreated ahead of the US Fed minutes meeting which could signal an interest rate hike next month. The US$1,200 level will serve as the immediate support level.

Economic Releases:

MY – Malaysia’s Interest Rate Decision – 23Nov16, 3.00PM

US – US’ October Durable Goods Orders – 23Nov16, 9.30PM

US – US’ New Home Sales – 23Nov16, 11.00PM

Bursa Malaysia Trade Statistics – 22Nov16

Institutions: Net BUY 72.8 mln (56.4%)

Retail: Net BUY 19.2 mln (14.8%)

Foreign: Net SELL 92.0 mln (28.8%)

Potential Momentum Stocks – 23Nov16

Stock Name: PRESTAR (9873)

Entry: Buy above RM0.625

Target: RM0.685 (9.6%), RM0.75 (20.0%)

Stop: RM0.585 (-6.4%)

Shariah: Yes

Technical: Symmetrical triangle breakout

Stock Name: RSAWIT (5113)

Entry: Buy above RM0.535

Target: RM0.585 (9.3%), RM0.61 (14.0%)

Stop: RM0.505 (-5.6%)

Shariah: Yes

Technical: Monitor for breakout

Source: Bloomberg, M+ Online

++++++++++++++

Uob Kay Hian Daily Top Pick, 23 Nov 2016

Raya, 0080

Close, 0.20

Breakout, 0.21

Buy TP, 0.27, 0.295

Support, 0.17

SL, 0.165

Time Frame, 2 Weeks to 2 Months

Dayang, 5141

Close, 0.91

Breakout, 0.92

Buy, TP, 1.11, 1.21

Support, 0.79

SL, 0.785

Time frame 2 weeks to 2 months

Bstead, 2771

Close, 2.17

Breakout, 2.21

Buy TP, 2.44, 2.59

Support, 2.09

SL, 2.08

Time frame, 2 weeks to 3 months

Thanks

++++++++++++=

Maybank Kim Eng Daily Kopi (22 November 2016)

Dow 19023.87 0.35%

S&P 2202.94 0.22%

Nasdaq 5386.35 0.33%

VIX 12.41 -0.08%

Nikkei 18162.94 0.31%

KOSPI 1983.47 0.89%

SSE 3248.35 0.94%

TWSE 9133.39 1.02%

HSI 22678.07 1.43%

STI 2822.2 0.20%

KLCI 1629.32 0.13%

USD/MYR 4.4210 -0.03%

EUR/MYR 4.709 -0.05%

GBP/MYR 5.5229 -1.20%

AUD/MYR 3.2746 -0.68%

SGD/MYR 3.1108 -0.26%

JPY/MYR 3.981 0.20%

(+/- chg refers to MYR relative perf)

Top U.S.Market News:

o US stocks keep going; Major indexes top milestones: Dow ends above 19,000 for first time ever, S&P ends above 2,200

o Investors keep pouring into riskier assets on speculation growth will accelerate.

o Dow, S&P 500, Nasdaq, and Russell 2000 all end at records for second straight day. Telecom and consumer discretionary the strongest sectors of the day

o Russell 2000 up 13 days in a row – the longest streak since February 1996.

o European markets marched higher, helped by mining stocks and financials

o Mitt Romney now seen as the leading candidate for State Secretary under President Trump – press

Stock News

o Gains were broad-based, with nine of the 11 main S&P sectors ending higher, led by consumer discretionary (+1.2%) and industrials (+0.5%); only health care (-1.4%) and energy (flat) finished out of the green, as WTI crude finished 0.4% lower at $48.07/bbl.

o Steel names U.S. Steel (X +11.4%), AK Steel (AKS +10.7%), Steel Dynamics (STLD +4.1%), Nucor (NUE +4.4%) and Commercial Metals (CMC +4.7%) all surge to 52-week highs.

o Three days before the busiest shopping day of the year, companies tracked by the Standard & Poor’s 1500 Retail Index surged 1.7% to an all-time high

o Vale (VALE) +7% following news that Indonesia will cut the royalty charged on sales of processed and refined nickel to 2% from 4%, a step the government hopes will encourage more miners to develop smelters.

o Analog Devices (ADI) shares jump 4.5% after beating est’s; FQ4 EPS of $1.05 beats by $0.16. Revenue of $1B (+2.2% Y/Y) beats by $57.42M.

o Disney (DIS) To embark on multi-year $1.4B expansion of theme park in Hong Kong

o HP (HPQ): FQ4 EPS of $0.36 in-line. Revenue of $12.5B (+1.9% Y/Y) beats by $620M.

Notable ADR News:

o Vipshop (VIPS -14.5%) shares get pummeled after revenue miss due to lower than expected active users growth. Shares were under pressure but selling accelerated on strong volume this afternoon.

o MACAU: Macau 3Q GDP rises 4% YoY- First Q expansion in 2 years

-3 Crown Resorts employees formally arrested (moved from detained status)

-Jewelry retailer proxy from Macau consumer Chow Tai Fook report 7-8 store closures in Macau/China

-Macau/HK SSS drop 26% YoY

-MGM China underperformed, gave back some of the 7% gain yesterday on CS upgrade

o Cognizant (CTSH -3.6%) BofAML cuts CTSH to Underperform from Buy, PT: $48 from $66- citing risk on US immigration reform and slower growth makes firm cautious near-term

o SINA shares +10%; 3Q Adj. EPS Beats Est. PT lowered to $121 from $123 at JPMorgan, maintains Overweight rating

o Weibo (WB) jumps 7% after Q3 results beat estimates and guided Q4 net rev higher. JPMorgan making positive comments; Reiterates Overweight rating, PT raised to $74 from $70 – Firm believes Weibo will continue to capture advertisers budget allocation in the next couple of years

o YY Price Target lowered to $60 from $67 at JPMorgan, maintains Overweight rating- citing music business slowdown

o 58.com (WUBA) Tencent reports 26% stake, down from 28.2%

* VIX: -0.08% to 12.41

* Volume 7.2B, 3% above the 3-month daily avg

* Treasury curve steepened modestly today after plunging for 10 days. The two-year yield finishing flat at 1.08% while the yield on the 10-year note slipped a basis point to 2.31%.

30-year -0.12%. 10-yr +0.02%. 5-yr +0.01%.

European Equity Highlights

STOXX 600 +0.23% 341.02

DAX +0.27% 10713.85

FTSE +0.62% 6819.72

CAC +0.41% 4548.35

* European markets marched higher, helped by mining stocks and financials

Forex

DXY 0.00% 101.05

Euro -0.06% vs. dollar. Yen +0.22%. Pound +0.61%.

*The DXY Index which had rallied for 10 consecutive sessions through Monday, ended basically unchanged today.

* MYR: ringgit was fractionally lower after reversing sharper losses earlier. MYR had dropped to 4.44, the lowest since September 2015. USD rally seems to be running out of steam ahead of US holiday weekend. MYR has lost nearly 5% since Nov 9 following the US elections and after the central bank clamped down on offshore ringgit trading.

Commodities:

CPO: +9 +0.10% 2928

* Palm oil extends gains, tracking stronger soy oil. Futures +18% YTD

For stock ideas and market flows, access Market Insight on Maybank Investment Bank http://bit.ly/1dsTxV9 and Maybank KE Trade SG mobile apps https://appsto.re/us/OY-Kw.i.

Download from Apple Store and Google Play now.

++++++++++++++++++=

investment consultant:

Bursa Malaysia Stocks

Wednesday 23/11/2016

Latest Currency exchange is RM4.40

Dear investors and traders, Hot STOCK PICKS FOR TOMORROW !!

Based on Emico result sentiment , here are the stocks recommendation :

1) Johotin – Excellent result , 1st TP RM1.5 , just join the party, every selling to bids is an opportunity for you to enter. Whoever has johotin shares, can try average up.

2) Biohldg – Good result but difficult to trade, try to trade at break up point.

3) Priva – slightly above average result, less popular stock, trade only if you are confident with it.

4)inno- result very good but already up so much, recommended by other people group, sell on news or jump in, its up to you.

Other than these three, there is nothing special about other companies result.

+++++++++++++++++

Dzulhilman M+ WM PR Traders:

Salam and Morning All

MACRO : Wall Street’s three main stock indexes hit record highs for a second straight day on Tuesday before trimming gains, while European shares also rose on expectations that markets would benefit from U.S. President-elect Donald Trump’s policies (investing. com).

MICRO : Market closed on positive notes yesterday. First session started off sluggish and ended active towards closing of the market. BNM intervene Ringgit from falling further. The next question would be how long and how strong can BNM protect Ringgit? Technically Ringgit has reached end of wave 5 of EW and should strenghtens from here onwards.

WHAT TO EXPECT? : We are not out of the woods yet. Selected counters shall be in play but generally market is cautious. Short term trading is ok as quater reports are coming in. Metal counters particularly has been maintaining support despite though market scene which makes them interesting to be in trading list.

Below are my Watch List for SWING counters (23/11/2016)

PRESTAR

EP : ABOVE 0.640

SL : BELOW 0.620

TP : 0.680/0.725

PECCA

EP : ABOVE 1.800

SL : BELOW 1.750

TP : 2.070

Happy trading.

=========================================================

# Interested to become a Remisier with MPlus? Come and talk to us now!!

#FYI we have 3 types of buycalls:

1 – SWING : Given every early morning such as above.

2 – CONTRA : Given in VIP Group before closing of market.

3 – INTRADAY : Live buy call during market operation in VIP Group.

#tepukdadatanyaselera

++++++++++++++

TradetheHotstocks, [23.11.16 07:06]

Market News Roundup

1⃣ Brahmal Vasudevan, the founder and CEO of private equity firm Creador SB, has emerged as a substantial shareholder of ICT training and certification provider PRESTARIANG.

2⃣ Loss-making YEN, in which GPACKET bought a 22% stake this year, is proposing a rights issue of up to 275m shares with an indicative issue price of 20sen per share, which could raise up to RM55m.

Financial Result Highlight

FGV saw its net loss widen to RM94.87m (2.6 sen/share) in 3QFY16, largely due to lower CPO production, higher raw sugar costs as well as lower earnings from downstream segment.

AAX registered its fourth consecutive profit in 3QFY16, with a net profit of RM11.03m. This is mainly due to increase in scheduled flight revenue, growth in ancillary income and rise in aircraft operating lease income.

HUAT LAI posted a 244% surge in net profit to RM45.2m (57.89 sen/share) in 3QFY16, due to higher revenue and stricter cost controls.

IOI PROP’s net profit grew 64.2% to RM189.57m (4.3 sen/share) in 1QFY17, mainly attributed to better revenue from property segments and leisure and hospitality segment.

JOHOTIN’s net profit more than tripled to RM10.79m (7.85 sen/share) in 3QFY16 due to higher sales, lower material costs and forex gain on financial settlement.

SALCON slipped into the red with a net loss of RM755k (0.11 sen/share) in 3QFY16, its quarterly performance was dragged by its other income.

DIALOG’s net profit climbed 35% y-o-y to RM81.33m in 1QFY17, on higher contribution from its JV, particularly the Pengerang Independent Terminals which has fully leased out its storage capacity.

Sources: theedgemarkets.com ; thestar.com

TradetheHotstocks, [23.11.16 07:08]

23rd November,2016 Overnight Markets Roundup

US MARKET

DJIA : 19,023.87 (+67.18)

S&P500 : 2,202.94 (+4.76)

NASDAQ : 5,386.35 (+17.49)

VIX : 12.41 (-0.01)

US stocks extended all-time highs, with the Dow topping 19,000 for the first time and small caps clocking the longest rally in 20 years, as investors poured into riskier assets on speculation growth will accelerate.

EUROPE/UK MARKET

FTSE : 6,819.72 (+41.76)

DAX : 10,713.85 (+28.72)

CAC 40 : 4,548.35 (+18.77)

Gains in miners pushed European equities to their highest levels in almost a month, mitigating a drag from drugmakers.

CHINA/HK MARKET

SHANGHAI : 3,249.58 (+31.43)

HSI : 22,678.07 (+320.29)

China stocks advanced, helped by a strong rally in blue-chips, in particular financial and energy shares, after US exchanges rose.

JAPAN MARKET

Nikkei : 18,162.94 (+56.92)

Japanese stocks extended their winning streak as a rally in oil companies overshadowed concerns following a magnitude 7.4 earthquake off the coast of Fukushima.

M’SIA MARKET

KLCI : 1,629.32 (+2.04)

KLCI climbed 0.1% as foreign investors turned into net buyers of Malaysian shares. Crude oil gains also contributed to the KLCI’s rise.

⬆️344⬇️410↔️366

By SARA H’NG/ALANTAN

OIL

WTI : 47.91

Brent : 49.12

Oil closed near $48 a barrel in New York after an OPEC committee failed to agree on Iranian and Iraqi production levels.

GOLD

GOLD : 1,211.50

Investors cut holdings in gold exchange-traded products, amid speculation that the Federal Reserve will raise US interest rates next month.

FX & BONDS

USD/MYR : 4.4200

EUR/MYR : 4.6971

GBP/MYR : 5.4900

AUD/MYR : 3.2721

HKD/MYR : 0.5699

SGD/MYR : 3.1027

USD/JPY : 111.10

Msia 10 yr Bond Yield : 4.339%

US 10 yr Bond Yield : 2.314%

22/11 BURSA TRADE STAT

Retail (14.8%) – net BUY RM19.14M

Institution (56.4%) – net BUY RM72.87M

Foreign (28.8%) – net SELL RM92.01M

Total traded value RM1.811B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

TradetheHotstocks, [23.11.16 07:10]

[ Photo ]

+++++++++++++++=

BKs Technical Ideas 23/11/2016

1) Mmsv

2) IJacobs

3) Krono

4) Vis (Ideas @ RM0.235 on 20/11/16)

Kindly refer to charts posted in BKs Channel.

Our Telegram Link: telegram.me/bursakakis

Our Facebook Link : https://www.facebook.com/groups/192414771167397/

DISCLAIMER: The comments here are for sharing and learning purposes and do not represent a recommendation to buy or sell. Kindly consult your remisiers or dealers before you take any action. Thank you.

++++++++++++++++

Logic Trading Analysis Channel, [22.11.16 21:00]

BURSA MALAYSIA MARKET IDEAS (23/11/2016):

FBMKLCI FAIL TO EXCITED WITH WORLD BULL

Dear All,

The FBMKLCI closed higher at +2.04 point or +0.13% to close at 1629.32.

FBMKLCI remain soft, while whole world rebound trend positive. Do not give up, we may still see some light from the tunnel for today.

DJIA ready to break 19000, Yes, Trump effect is strong, and we need someone like TRUMP in Malaysia in order to make Malaysia Boleh Again !

Yesterday a lot company posting result, not much exciting.

In our Premium Groups, we start to commenting on company’s result, one of the company have been mention potential FIFO yesterday like EMICO doing well.

Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

People are blind to reality and only see what they want to see this Wednesday !

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

Views – 277

++++

[11/22, 8:33 AM] Rosdi maybank: Reuters-U.S. stocks climbed on Monday to close at a record and European equity markets also moved higher as a jump in oil prices helped spur gains in the energy sector.

Brent LCOc1 settled up 4.4 percent at $48.90 and U.S. crude CLc1 settled 3.9 percent higher at $47.49 after touching their highest levels in about three weeks as the dollar weakened. Comments by Russian President Vladimir Putin that raised expectations major oil producing countries could reach a deal to limit output at a meeting next week also spurred the jump in oil prices.

Among U.S. equities, the S&P energy index .SPNY gained 2.2 percent as the top-performing sector, closing at its highest level in 16 months.

“The post-election rally is continuing,” said Bucky Hellwig, senior vice president at BB&T Wealth Management in Birmingham, Alabama. “There was some concern that rates might rise too far, but it looks like they may have slowed down a little bit.”

The Dow Jones industrial average .DJI rose 88.76 points, or 0.47 percent, to 18,956.69, the S&P 500 .SPX gained 16.28 points, or 0.75 percent, to 2,198.18 and the Nasdaq Composite .IXIC added 47.35 points, or 0.89 percent, to 5,368.86.

[11/22, 8:34 AM] Rosdi maybank: Maybank Kim Eng Daily Kopi (21 November 2016)

Dow 18956.69 0.47%

S&P 2198.18 0.75%

Nasdaq 5368.86 0.89%

VIX 12.42 -3.35%

Nikkei 18106.02 0.77%

KOSPI 1966.05 -0.43%

SSE 3218.15 0.79%

TWSE 9041.11 0.36%

HSI 22357.78 0.06%

STI 2816.67 -0.77%

KLCI 1627.28 0.21%

USD/MYR 4.4198 -0.03%

EUR/MYR 4.7067 -0.43%

GBP/MYR 5.4566 0.53%

AUD/MYR 3.2523 0.36%

SGD/MYR 3.1026 -0.06%

JPY/MYR 3.9882 -0.11%

(+/- chg refers to MYR relative perf)

Top U.S.Market News:

o US stocks hit all-time highs. S&P 500, Dow and Nasdaq Composite all hit new record highs

o While the Dow and NASDAQ had previously set new records in the past few trading days, this is the first time the S&P 500 has joined them during the run up in recent weeks.

o NASDAQ led the way, rising 0.8%, while the S&P 500 added 0.7%. S&P and Dow are now up over 8% from the limit down lows of the election.

o Party like its 1999: Today is 1st time since 12/31/99 that S&P 500, Dow, NASDAQ, Russell 2000, and S&P 400 Midcap all closed at new highs.

o Today’s trading volume was below the recent levels of the last 2 weeks or so.

o The Treasury selloff took a break, allowing the yield on the 10-year note to stabilize after hitting multimonth highs last week.

o Oil at 3-week high as Russia’s Putin feeds expectations for OPEC output deal. Putin said he sees a “high probability” that an agreement to curb oil production will be reached at the Nov. 30 meeting in Vienna.

o British PM Theresa May confirmed the government will not seek an extension to the Article 50 process and plans to exit the EU by end-March 2019.

o 6.9 mag quake hits northeastern Japan, near Tokyo – Japan issues warning for possible 3 meter Tsunami in Fukushima: NHK

Stock News

o Energy sector rallied 2.4% as U.S. crude oil climbed 4%. The utilities (+1.1%) and tech (+1.1%) sectors also outperformed while real estate (-0.2%) lagged; the financial sector (+0.3%) turned in a flattish showing as flattening in the yield curve weighed on banking names.

o FANG stocks — Facebook (FB), Amazon.com (AMZN), Netflix (NFLX) and Alphabet (GOOGL) — outperformed in the Nasdaq 100, with gains ranging from 1% to 4%.

o Rout in Poultry names continues- TSN report dismal. SAFM, PPC down- TSN CEO stepping down. Recall last week Washington Post story that companies were colluding to inflate chicken place for years

o Tyson Foods (TSN) tumbled after whiffing on earnings. The stock fell 14.5% after the company posted earnings of $0.96. Analysts had projected earnings of $1.16 per share.

o Facebook (FB +4%) expanding UK headcount, new London HQ under construction. Overall employment in the UK to increase by 50% to 1,500 positions in 2017

o Amazon (AMZN +2.6%) considering offering a premium sports content package with Prime membership.

o Buzzfeed raised another $200 million from NBC Universal. The deal will value the online news company at $1.5 billion. This is the second year in a row that NBCUniversal has made a $200 million investment in Buzzfeed.

o Symantec (SMYC +3.25%) is buying security firm LifeLock for $2.3 billion. The deal will be funded by cash and new debt. Symantec also bought internet security firm Blue Coat for $4.7 billion in June.

o Starbucks (SBUX +0.5%) may have quietly increased prices in the last few weeks – TheStreet cites anecdotal checks from receipts in NYC and comments from a barista

o Constellation Brands (STZ +1.6%) approves a new buyback program of $1B worth of stock.

o Citigroup (C +0.2%) adds $1.75 to buyback

Notable ADR News:

o Dual listed ADRs hovered around parity though the notional levels were higher. China oil plays strong thanks to a lift in crude, ala hopes of output freezes

o Alibaba (BABA-0.2%) is planning to invest USD300m into Sanjiang Shopping Club (601116 CH) for a 32% stake. Sanjiang owns 160 supermarkets mainly around Zhejiang province and is one of the largest supermarket chains in the region. We believe this is in line with the Alibaba’s push on its Tmall supermarket business and to compete with JD’s recent cooperation with Yihaodian’s fresh delivery business. Tmall supermarket’s volume is growing fast at 200% in FY1Q17 and again triple digit in FY2Q17. Alibaba will remain as 2nd largest shareholder and allow Sanjiang to run independently after the investment, a similar strategy adopted in many of its past investments.

o Alibaba Cloud expands global offering with four new data centers by the end of 2016 in the Middle East (Dubai), Europe, Australia and Japan.

o MACAU: CS raises MPEL, Sands China, and MGM China to Outperform. Wynn Macau to Neutral. Yuan weakening, China capital outflows further injected liquidity into junket system.

o YY Reports Q3 $1.12 v $0.71 y/y, R$313.4M v $234.4M y/y – Guides Q4 net revenues RMB2.4-2.5B, +26.3-31.6% y/y- Gross margin 39.0% v 39.2% y/y. Stock had fallen-17% in last month

o JD.com (JD -2%) New Street Research reiterates Buy and Street-high $40 PT

o Tuniu (TOUR -0.3%) said that they will separate their businesses into two major sections: a tourism and resort subsidiary and a financial and technology subsidiary.

o Eros Now (EROS -2.30%) Announces Distribution Partnership with Vodafone for integration with Vodafone Play.

After the Close:

o Vipshop (VIPS): Q3 EPS of $0.15 beats by $0.01. Revenue of $1.8B in-line. Conf call in the morning. Shares fall 4%

o SINA Reports Q3 Adj. EPS $0.56 vs $0.35 Est., Sales $274.9M vs $265.3M Est. SINA +1% after hours

o Weibo (WB) Reports Q3 EPS $0.24 vs. Est. $0.20, Rev. $176.9M vs. Est. $173M. WB +1.5% after hours.

* VIX: -3.35% to 12.42

* Volume 6.6B, 5% below the 3-month daily avg

* Treasury prices rose and two-year yield closed lower by a basis point to 1.06% while 10-year yield slipped 5 bps to 2.30%. 30Y yields dropped back below 3.00%

30-year +0.35%. 10-yr +0.25%. 5-yr +0.1%.

European Equity Highlights

STOXX 600 +0.25% 340.23

DAX +0.19% 10685.13

FTSE +0.03% 6777.96

CAC +0.56% 4529.58

* European markets end higher. Stoxx Europe 600 was slightly better, as gains for energy and mining stocks fought off drops by Italian banks.

* German Chancellor Angela Merkel announced her candidacy for a fourth term in the September 2017 elections, as most had been expecting and France’s ex-President Nicholas Sarkozy lost his bid for re-election over the weekend.

Forex

DXY +0.52% 100.93

Euro +0.35% vs. dollar. Yen +0.14%. Pound -1.21%.

* Dollar slides after 10 days of gains; euro rises. British pound drops after PM May confirms no extension of Brexit process.

* MYR: ringgit continues to slide, ending slightly lower to hit weakest level in 13 months.

Commodities:

CPO: +50 +1.78% 2919

* Palm oil extends recent gains, up almost 2% on weak ringgit. The rise in soybean oil also contributing.

For stock ideas and market flows, access Market Insight on Maybank Investment Bank http://bit.ly/1dsTxV9 and Maybank KE Trade SG mobile apps https://appsto.re/us/OY-Kw.i.

Download from Apple Store and Google Play now.

Stay Ahead, Trade Smart

[11/22, 8:35 AM] Rosdi maybank: KLSE StockAlliance:

22/11/2016 Stock Picks

1. PRLEXUS / KIMLUN / TECGUAN

2. INNO / HIL / IREKA

3. AEGB / PASDEC / WOODLAN

4. Follow us closely during trading hours

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

[11/22, 9:29 AM] Rosdi maybank: UOBKH Retail Market Monitor 22 November 2016

FBMKLCI 1,627.28 (+3.48,+0.21%)

Support: 1,612, 1,600

Resistance: 1,665, 1,680

The index rose yesterday as index-linked counters rebounded strongly.

Top Gainers: Hong Leong Financial Group (+2.7%), Genting Malaysia

(+2.2%) and Astro Malaysia Holdings (+1.9%)

Top Losers: RHB Bank (-2.1%), YTL Corporation (-1.3%) and Petronas

Dagangan (-1.0%)

US stocks closed higher on Monday on the back of rising oil prices and

a pullback in the dollar, giving the three major US indices their third simultaneous all-time closing highs this year. Stocks got a lift from energy stocks as oil prices jumped. Investors are hoping that

OPEC countries will soon finalise a deal that would cut oil production and help support prices. Gold for December delivery was up 0.4%, or US$4.70, to US$1213.40 a troy ounce. Rising stocks outnumbered

declining ones on the NYSE by 2,314 to 857 and 80 ended unchanged.

Stocks to watch:

1) VISDYNAMICS HOLDINGS; Technical Buy with +31.4% potential return

*Last: RM0.245 Target: RM0.295, RM0.335 Stop: RM0.210

*Timeframe: 2 weeks to 2 months

2) OCEANCASH PACIFIC; Technical BUY with +20.7% potential return

*Last: RM0.410 Target: RM0.470, RM0.495 Stop: RM0.370

*Timeframe: 2 weeks to 2 months

3) PROLEXUS; Technical BUY with +15.7% potential return

*Last: RM1.66 Target: RM1.84, RM1.92, Stop: RM1.52

*Timeframe: 2 weeks to 2 months

[11/22, 9:31 AM] Rosdi maybank: Good morning. Despite the weak Ringgit, the FBMKLCI ended Monday on a positive tone, gaining 3.48 points or 0.21%. Today, the local benchmark barometer is likely to be sluggish as we believe that the overnight rebound in oil prices might be offset by the recent hawkish remark from the US President-elect Donald Trump, who said he would withdraw the US from a Trans-Pacific Partnership trade deal on his first day in office on the 20th Jan 2017. We also caution that the oil prices would likely to be choppy ahead of the OPEC meeting on the 30th Nov. Hence, traders are advised to trade cautiously on the oil & gas related counters. Resistance: 1,652 & 1,667. Support: 1,611 & 1,600.

*Trading Stocks today:*

Malaysia:

*A-Rank (7214)* (RM0.93): Buy

Target: RM1.08

Cut loss: RM0.85

*Salutica (0183)* (RM1.36): Buy

Target: RM1.74

Cut loss: RM1.25

Singapore:

*Jumbo Group* (S$0.655): Buy

Target: S$0.73

Cut loss: S$0.59

*United Engineers* (S$2.75): Sell

Target: S$2.41

Stop loss: S$2.78

Hong Kong:

*Dynamic Holdings* (HK$5.00): Buy

Target: HK$5.80-5.85

Cut loss: HK$4.68

*KuangChi Science* (HK$2.92): Buy

Target: HK$3.45-3.55

Cut loss: HK$4.73

*Fundamental Report(s):*

*Economic Update* – Ringgit lashed by volatility

*WCT Holdings* – No breakout in infra margins, for now (Maintained Add with a tp of RM2.16)

*Star Media Group Bhd* – Waiting to shine (Maintained Add with a tp of RM2.70)

*AMMB Holdings* – Another qoq earnings recovery in 2QFY17 (Maintained Add with a higher tp of RM5.00)

*QL Resources* – Improved livestock performance in 2QFY17 (Maintained Hold with a lower tp of RM4.27)

*Malakoff Corporation* – Dimmer earnings outlook (Maintained Hold with a lower tp of RM1.41)

*Pharmaniaga Bhd* – Sore 9M16 (Maintained Reduce with a tp of RM5.00)

*MSM Malaysia Holdings* – A perfect storm (Downgrade Reduce with a lower tp of RM3.50)

*Signature International* – Awaiting a sign (Maintained Add with a lower tp of RM1.30)

*22nd Nov 2016*

[11/22, 12:35 PM] Rosdi maybank: *M+ Online Morning Buzz – 22Nov16*

*Dow Jones: 18,956.69 pts (+88.76pts, +0.47%)*

U.S. stockmarkets advanced overnight as the Dow notched a record closing, lifted by gains in crude oil prices. The Dow could head towards the 19,000 level.

*FBM KLCI: 1,627.28 pts (+3.48pts, +0.21%)*

The FBM KLCI halted a three-consecutive winning streak as buying interest was distinct among selective banking heavyweights. The immediate support level is located around the 1,610 level.

*Crude Palm Oil: RM2,919 (+RM50, +1.74%)*

Crude palm oil prices rebounded, tracking the gains in soybean oil coupled with the persistent weakness in Ringgit. The RM3,000 level will serve as the immediate resistance level.

*WTI Crude Oil: $48.24 (+$2.79, +6.11%)*

Crude oil prices extended its gains on optimism over OPEC production cut deal. Crude oil prices might head towards the US$50 level.

*Gold: $1,214.23 (+$6.34, +0.52%)*

Gold prices rebounded from around the US$1,200 level after the US Dollar retreated. The US$1,200 level will serve as the immediate support level.

*Economic Releases:*

US – October Existing Home Sales – 22Nov16, 11.00PM

*Bursa Malaysia Trade Statistics – 21Nov16*

Institutions: *Net SELL* 17.8 mln (54.4%)

Retail: *Net BUY* 16.5 mln (17.6%)

Foreign: *Net BUY* 1.3 mln (28.0%)

*Potential Momentum Stocks – 22Nov16*

*Stock Name: OCNCASH (0049)*

Entry: Buy above RM0.40

Target: RM0.43 (7.5%), RM0.47 (17.5%)

Stop: RM0.385 (-3.8%)

Shariah: Yes

Technical: Short-term consolidation breakout

*Stock Name: MKH (6114)*

Entry: Buy above RM2.790

Target: RM3.00 (7.5%), RM3.17 (13.6%)

Stop: RM2.67 (-4.3%)

Shariah: Yes

Technical: Short-term consolidation breakout

_*Source: Bloomberg, M+ Online*_

+++++++====

Logic Trading Analysis Channel, [21.11.16 23:12]

BURSA MALAYSIA MARKET IDEAS SELLING (22/11/2016):

FBMKLCI FOREIGN FUND STOP SELLING ?

Dear All,

The FBMKLCI closed higher at +3.48 point or +0.21% to close at 1627.28.

FBMKLCI yesterday stop falling since foreign fund stop selling, hopefully foreign fund will continue stop selling, then our market will at least stable a bit.

DJIA still sideways at peak, high chance to break 19000, if fail and watefall down, then will be pretty damage to all market. Since whole world slightly little positive, hopefully this can roll into more positive then will be great.

Yesterday a lot company posting result, not much exciting. Hopefully coming few day will see more company posting better result.

Trade carefully !

Welcome to our live channel :

https://telegram.me/ltachannel !

There are so many beautiful reasons to be happy this Tuesday!

“Goreng Tetap Goreng” !

Yours Sincerely,

Logic Trading Analysis

+++++++++++++=

TradetheHotstocks, [22.11.16 06:51]

Market News Roundup

1⃣ KLK plans to acquire a bigger stake in PT Perindustrian Sawit Synergi, a downstream palm oil producer in Indonesia, by upping its stake in JV from 63% to 75%.

2⃣ MQ TECH, which is planning to diversify into the theme park business, saw its renounceable rights issue with free warrants under-subscribed by 34.22%.

3⃣ PERISAI said it has within 60 days from Nov 10 to submit a proposed debt restructuring scheme to the Corporate Debt Restructuring Committee.

4⃣ FAJAR is buying a piece of freehold land measuring 676 sq meter within the central business district of Melbourne, Australia, for RM84.15m cash.

5⃣ MKH is teaming up with PR1MA Corp Malaysia to jointly develop a piece of freehold land measuring 33,280 square metres (8.22 acres) in Kajang into a mixed project with GDV of RM464m.

6⃣ RHB is eyeing the top 3 spot in the Islamic banking space for its syariah complaint unit, with a 3-year aim to rapidly boost its profits and asset size.

Financial Result Highlight

WCT’s net profit plunged 72.1% to RM23.97m (1.92 sen/share) for 3QFY16 mainly due to high unrealised forex gain in 3QFY15.

Higher raw material costs and a weaker ringgit have eroded MSM’s profitability by 63.5% in 3QFY16.

PHARMANIAGA’s net profit fell 34.6% to RM13.06m (5.04 sen/share) in 3QFY16 on lower revenue. The group declared a 3rd interim dividend of RM0.04 per share.

EPF’s investment income surged 29.21% to RM12.32b in 3QFY16.

MALTON’s net profit in 1QFY17 rose 44.4% y-o-y to RM6.26m, mainly on higher revenue from its property development division.

Sources: theedgemarkets.com ; thestar.com

++++++++++++++++++++==

TradetheHotstocks, [22.11.16 06:57]

22nd November, 2016 Overnight Markets Roundup

US MARKET

DJIA : 18,956.69 (+88.76)

S&P500 : 2,198.18 (+16.28)

NASDAQ : 5,368.86 (+47.35)

VIX : 12.34 (-0.51)

All 3 major US stock indexes finished at record highs, extending the market’s post-election rally as energy and other commodity-related shares gained and Facebook led a jump in technology.

EUROPE/UK MARKET

FTSE : 6,777.96 (+2.19)

DAX : 10,684.25 (+19.69)

CAC 40 : 4,531.50 (+27.15)

A rally in commodity producers helped European equities erase declines, sending the shares for their longest streak of intraday fluctuations in more than 3 years.

CHINA/HK MARKET

SHANGHAI : 3,218.21 (+25.35)

HSI : 22,357.78 (+13.57)

Chinese stocks rose in HK & Shanghai as insurers gained with construction firms amid speculation the outlook for earnings is improving.

JAPAN MARKET

Nikkei : 18,106.02 (+138.61)

Nikkei rose, gaining for 4th day after a further weakening in the yen boosted overall sentiment, while mining stocks staged a rally thanks to rising oil prices.

M’SIA MARKET

KLCI : 1,627.28 (+3.48)

KLCI settled 0.21% higher on bargain hunting activities after having languished in the red for 3 days last week.

⬆️365⬇️409↔️343

OIL

WTI : 48.27

Brent : 48.95

Oil climbed as Iran signaled optimism that OPEC will agree to a supply-cut deal and Iraq said it will make new proposals to help bolster unity before next week’s meeting in Vienna.

GOLD

GOLD : 1,212.90

Gold rebounding from 5-1/2 month lows as the dollar shed some of the hefty gains made the previous week on bets that US president-elect Donald Trump’s plans for fiscal stimulus would prove inflationary.

FX & BONDS

USD/MYR : 4.4165

EUR/MYR : 4.6939

GBP/MYR : 5.5165

AUD/MYR : 3.2532

HKD/MYR : 0.5694

SGD/MYR : 3.1013

USD/JPY : 110.89

Msia 10 yr Bond Yield : 4.385%

US 10 yr Bond Yield : 2.323%

21/11 BURSA TRADE STAT

Retail (17.6%) – net BUY RM16.47M

Institution (54.4%) – net SELL RM17.77M

Foreign (28.0%) – net BUY RM1.30M

Total traded value RM1.381B

By SARA H’NG/ALAN TAN

Sources: investing.com, cnbc.com, reuters.com, bloomberg.com, barrons.com, klsescreener.com, theedgemarkets.com & thestar.com

Views – 254

GHLSYS

Views – 295