John Murphy’s Ten Laws of Technical Trading

StockCharts.com’s Chief Technical Analyst, John Murphy, is a very popular author, columnist, and speaker on the subject of Technical Analysis. John’s “Ten Laws of Technical Trading” is the best guide available anywhere for people who are new to the field of charting. I urge you to print out this page and refer to it often. If you find this information useful, consider subscribing to StockCharts.com which will allow you to read John’s latest market commentary.

Which way is the market moving? How far up or down will it go? And when will it go the other way? These are the basic concerns of the technical analyst. Behind the charts and graphs and mathematical formulas used to analyze market trends are some basic concepts that apply to most of the theories employed by today’s technical analysts.

John Murphy, StockCharts.com’s Chief Technical Analyst, has drawn upon his thirty years of experience in the field to develop ten basic laws of technical trading: rules that are designed to help explain the whole idea of technical trading for the beginner and to streamline the trading methodology for the more experienced practitioner. These precepts define the key tools of technical analysis and how to use them to identify buying and selling opportunities.

Before joining StockCharts, John was the technical analyst for CNBC-TV for seven years on the popular show Tech Talk, and has authored three best-selling books on the subject: Technical Analysis of the Financial Markets, Trading with Intermarket Analysis and The Visual Investor.

His most recent book demonstrates the essential visual elements of technical analysis. The fundamentals of John’s approach to technical analysis illustrate that it is more important to determine where a market is going (up or down) rather than the why behind it.

The following are John’s ten most important rules of technical trading:

- Map the Trends

- Spot the Trend and Go With It

- Find the Low and High of It

- Know How Far to Backtrack

- Draw the Line

- Follow That Average

- Learn the Turns

- Know the Warning Signs

- Trend or Not a Trend?

- Know the Confirming Signs

1. Map the Trends

Study long-term charts. Begin a chart analysis with monthly and weekly charts spanning several years. A larger scale map of the market provides more visibility and a better long-term perspective on a market. Once the long-term has been established, then consult daily and intra-day charts. A short-term market view alone can often be deceptive. Even if you only trade the very short term, you will do better if you’re trading in the same direction as the intermediate and longer term trends.

2. Spot the Trend and Go With It

Determine the trend and follow it. Market trends come in many sizes – long-term, intermediate-term and short-term. First, determine which one you’re going to trade and use the appropriate chart. Make sure you trade in the direction of that trend. Buy dips if the trend is up. Sell rallies if the trend is down. If you’re trading the intermediate trend, use daily and weekly charts. If you’re day trading, use daily and intra-day charts. But in each case, let the longer range chart determine the trend, and then use the shorter term chart for timing.

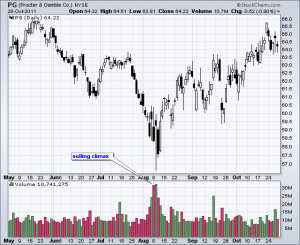

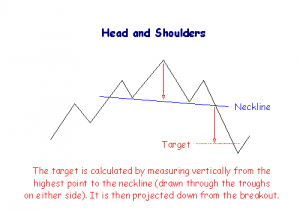

3. Find the Low and High of It

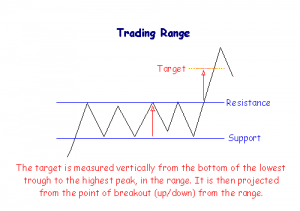

Find support and resistance levels. The best place to buy a market is near support levels. That support is usually a previous reaction low. The best place to sell a market is near resistance levels. Resistance is usually a previous peak. After a resistance peak has been broken, it will usually provide support on subsequent pullbacks. In other words, the old “high” becomes the new low. In the same way, when a support level has been broken, it will usually produce selling on subsequent rallies – the old “low” can become the new “high.”

4. Know How Far to Backtrack

Measure percentage retracements. Market corrections up or down usually retrace a significant portion of the previous trend. You can measure the corrections in an existing trend in simple percentages. A fifty percent retracement of a prior trend is most common. A minimum retracement is usually one-third of the prior trend. The maximum retracement is usually two-thirds. Fibonacci retracements of 38% and 62% are also worth watching. During a pullback in an uptrend, therefore, initial buy points are in the 33-38% retracement area.

5. Draw the Line

Draw trend lines. Trend lines are one of the simplest and most effective charting tools. All you need is a straight edge and two points on the chart. Up trend lines are drawn along two successive lows. Down trend lines are drawn along two successive peaks. Prices will often pull back to trend lines before resuming their trend. The breaking of trend lines usually signals a change in trend. A valid trend line should be touched at least three times. The longer a trend line has been in effect, and the more times it has been tested, the more important it becomes.

6. Follow that Average

Follow moving averages. Moving averages provide objective buy and sell signals. They tell you if existing trend is still in motion and help confirm a trend change. Moving averages do not tell you in advance, however, that a trend change is imminent. A combination chart of two moving averages is the most popular way of finding trading signals. Some popular futures combinations are 4- and 9-day moving averages, 9- and 18-day, 5- and 20-day. Signals are given when the shorter average line crosses the longer. Price crossings above and below a 40-day moving average also provide good trading signals. Since moving average chart lines are trend-following indicators, they work best in a trending market.

7. Learn the Turns

Track oscillators. Oscillators help identify overbought and oversold markets. While moving averages offer confirmation of a market trend change, oscillators often help warn us in advance that a market has rallied or fallen too far and will soon turn. Two of the most popular are the Relative Strength Index (RSI) and Stochastics. They both work on a scale of 0 to 100. With the RSI, readings over 70 are overbought while readings below 30 are oversold. The overbought and oversold values for Stochastics are 80 and 20. Most traders use 14-days or weeks for stochastics and either 9 or 14 days or weeks for RSI. Oscillator divergences often warn of market turns. These tools work best in a trading market range. Weekly signals can be used as filters on daily signals. Daily signals can be used as filters for intra-day charts.

8. Know the Warning Signs

Trade MACD. The Moving Average Convergence Divergence (MACD) indicator (developed by Gerald Appel) combines a moving average crossover system with the overbought/oversold elements of an oscillator. A buy signal occurs when the faster line crosses above the slower and both lines are below zero. A sell signal takes place when the faster line crosses below the slower from above the zero line. Weekly signals take precedence over daily signals. An MACD histogram plots the difference between the two lines and gives even earlier warnings of trend changes. It’s called a “histogram” because vertical bars are used to show the difference between the two lines on the chart.

9. Trend or Not a Trend

Use ADX. The Average Directional Movement Index (ADX) line helps determine whether a market is in a trending or a trading phase. It measures the degree of trend or direction in the market. A rising ADX line suggests the presence of a strong trend. A falling ADX line suggests the presence of a trading market and the absence of a trend. A rising ADX line favors moving averages; a falling ADX favors oscillators. By plotting the direction of the ADX line, the trader is able to determine which trading style and which set of indicators are most suitable for the current market environment.

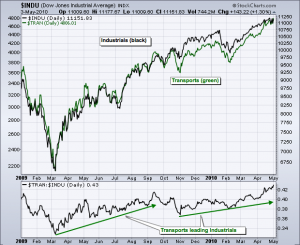

10. Know the Confirming Signs

Include volume and open interest. Volume and open interest are important confirming indicators in futures markets. Volume precedes price. It’s important to ensure that heavier volume is taking place in the direction of the prevailing trend. In an uptrend, heavier volume should be seen on up days. Rising open interest confirms that new money is supporting the prevailing trend. Declining open interest is often a warning that the trend is near completion. A solid price uptrend should be accompanied by rising volume and rising open interest.

“11.”

Technical analysis is a skill that improves with experience and study. Always be a student and keep learning.

- John Murphy

Views – 161

Recent Comments