Commodity Channel Index

The Commodity Channel Index measures the position of price in relation to its moving average. This can be used to highlight when the market is overbought/oversold or to signal when a trend is weakening. The indicator is similar in concept to Bollinger Bands but is presented as an indicator line rather than as overbought/oversold levels.

The Commodity Channel Index was developed by Donald Lambert and is outlined in his book Commodities Channel Index: Tools for Trading Cyclic Trends.

Trading Signals

Commodity Channel Index is best used in conjunction with trailing buy- and sell-stops.

Ranging Market

- Go long if the CCI turns up from below -100.

- Go short if the CCI turns down from above 100.

Trending Market

Divergences are stronger signals that occur less frequently. They are mostly used to trade intermediate cycles.

- Go long on a bullish divergence.

- Go short on a bearish divergence.

Example

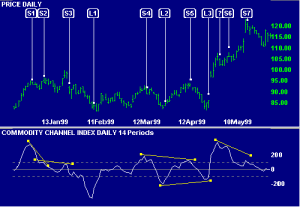

IBM Corporation with 14 day Commodity Channel Index. The days shown are the signal days. Trades are entered using trailing buy- and sell-stops on the day following.

S1: Go short – Commodity Channel Index turns down above the overbought line. This trade is stopped out at the rally before S2.

S2: Go short – bearish divergence. This trade is stopped out during the rally before S3.

S3: Go short – bearish triple divergence.

L1: Go long – Commodity Channel Index turns up from below the oversold line. The next day closes below the low of the signal day, causing the trade to be stopped out. A trailing buy-stop would stop us back in two days later.

S4: Go short – Commodity Channel Index turns down above the overbought line.

L2: Go long – Commodity Channel Index turns up from below the oversold line.

S5: Go short – Commodity Channel Index turns down above the overbought line and bearish divergence occurs.

L3: Go long – Commodity Channel Index turns up from below the oversold line and bullish divergence occurs.

?: The market is now trending (evidenced by the break above the previous high).

Do not go short when Commodity Channel Index turns down above the overbought line – wait for a bearish divergence.

S6: Go short – bearish divergence.

S7: Even stronger signal – bearish triple divergence

.

Setup

The default Commodity Channel Index is set at 20 days with Overbought/Oversold levels at 100/-100. To alter the default settings – Edit Indicator Settings.

Views – 246

Recent Comments